Municipal Bonds: Safe Income for Smart Investors

When you buy a municipal bond, a loan you give to a state, city, or local government to fund public projects like schools, roads, or water systems. Also known as state bonds, they’re one of the few investments where the interest you earn is usually free from federal taxes—and often state and local taxes too, if you live where the bond was issued. That tax break can make a big difference, especially if you’re in a higher tax bracket. Unlike corporate bonds, which pay interest based on a company’s profits, municipal bonds are backed by the taxing power of the government that issued them. That’s why they’re considered among the safest fixed-income options available.

Most municipal bonds come in two flavors: general obligation bonds, backed by the full faith and credit of the issuing government, meaning they can raise taxes to pay you back, and revenue bonds, paid back from the income generated by the project they fund—like tolls from a bridge or fees from a sewer system. The difference matters because revenue bonds carry a bit more risk—if the project doesn’t bring in enough cash, payments could be delayed. But even then, defaults are rare. Since 1970, less than 0.1% of municipal bonds have defaulted, according to Moody’s. That’s lower than corporate bonds, and far below junk bonds.

You don’t need to buy individual bonds to get in. Many investors use municipal bond funds, mutual funds or ETFs that hold dozens or hundreds of bonds at once. These give you instant diversification and professional management, which helps smooth out the ups and downs. They’re especially useful if you don’t have a lot of money to invest—most individual bonds start at $5,000 or more. Funds let you start with just $100. But watch out: funds don’t guarantee principal, and their value can drop when interest rates rise. Individual bonds held to maturity? You get your full principal back, no matter what.

They’re not perfect. If you’re in a low tax bracket, the tax savings might not be worth it. And if you’re investing in a bond from a state you don’t live in, you might still owe state taxes. Also, while they’re safe, they don’t grow your wealth fast. You’re not buying Apple stock—you’re buying a promise that your city will fix its potholes and pay you back with interest. That’s fine if you’re saving for retirement, building an emergency fund, or just want to reduce the stress of market swings. But if you’re chasing high returns, you’ll need other assets too.

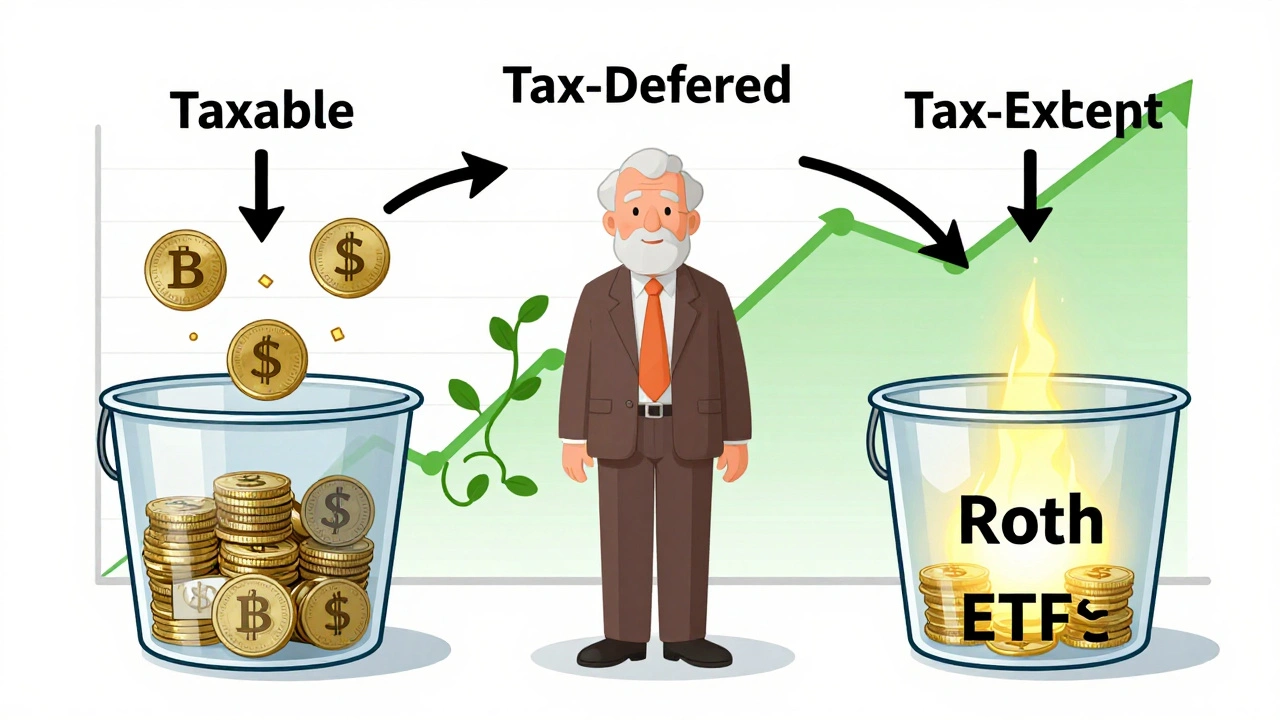

What you’ll find below is a collection of real, practical posts that help you connect municipal bonds to the bigger picture of investing. You’ll see how they fit into taxable accounts, how they compare to Treasury bills, how interest rates move them, and how to avoid common traps. No fluff. No jargon. Just clear, actionable info from people who’ve actually used these tools to build stable, tax-smart portfolios.