Mixed Signals in Investing: What They Mean and How to Respond

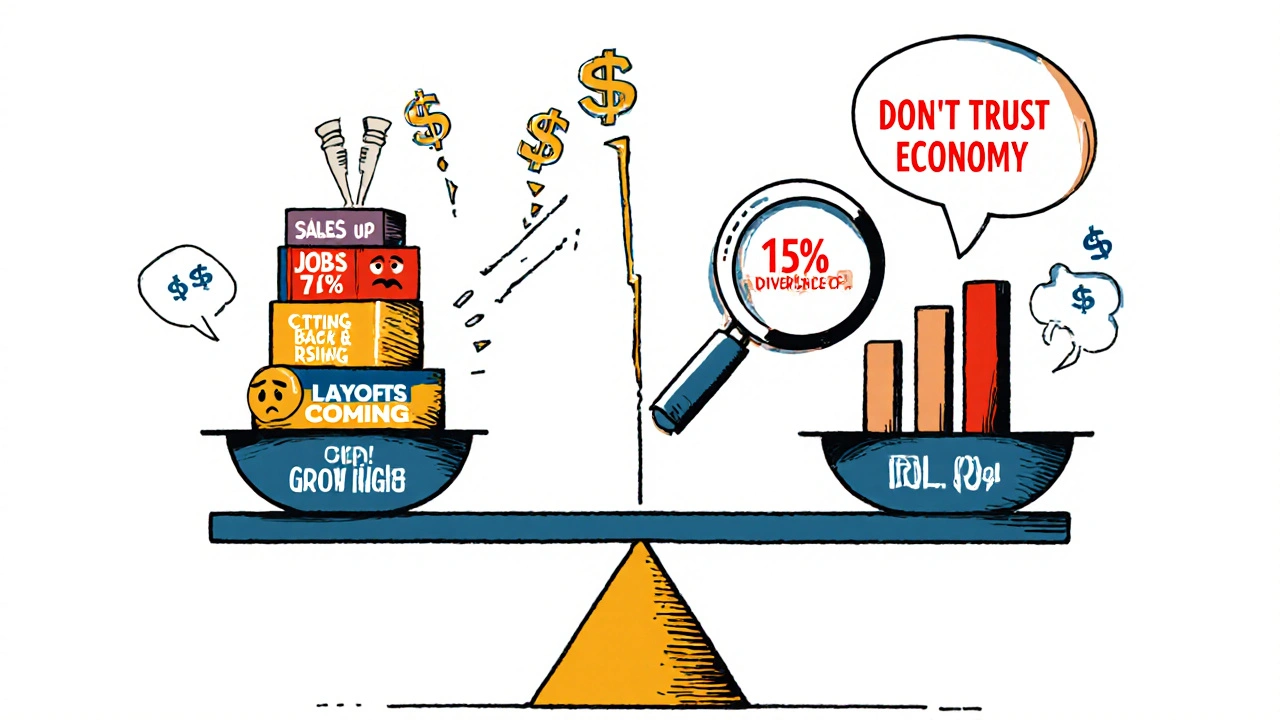

When your mixed signals, conflicting indicators that pull your investment decisions in different directions show up, it’s not a glitch—it’s normal. Markets don’t always scream clear answers. One tool says buy, another says sell, and a third just sits there quiet. This isn’t chaos; it’s the market whispering in two voices at once. You’re not missing something—you’re seeing reality. technical analysis, the practice of using price patterns and indicators to forecast market moves gives you tools like the MACD indicator, a momentum-based tool that tracks trend changes and potential reversals, but even the best ones can lie when the bigger picture is unclear. That’s why trading signals, alerts generated by indicators, price breaks, or volume spikes need context. A single signal never tells the whole story.

What causes mixed signals? Often, it’s timing. A stock might be overbought on a daily chart but still in a strong weekly uptrend. Or a company’s dividend looks safe based on payout ratios, but its cash flow is drying up—something your dividend safety score, a metric that estimates how secure a company’s dividend payments are might miss if it’s not looking at real-time data. Even market indicators, tools like moving averages, RSI, or volume trends used to gauge market sentiment can disagree because they measure different things. One looks at momentum, another at volume, another at price extremes. They’re not supposed to always agree. The trick is knowing which ones matter most for your strategy. If you’re holding dividend stocks, a rising payout ratio might be more urgent than a MACD crossover. If you’re trading options, a sudden spike in implied volatility could override everything else. Mixed signals don’t mean you should stop investing—they mean you need to layer your thinking. Combine indicators with fundamentals. Watch what the price does after the signals appear. Ask yourself: Is this noise, or is the market trying to tell me something big?

What you’ll find below isn’t a list of fixes. It’s a collection of real tools, real data, and real stories from investors who’ve been stuck in the middle of mixed signals—and figured out how to move forward. From decoding MACD signals, the crossovers and divergences that suggest trend shifts to understanding why call options, contracts that give you the right to buy stock at a set price can help you hedge against uncertainty, these posts show you how to turn confusion into clarity. You’ll learn how to spot when a dividend cut is coming before the news breaks, how to use market cap, the total value of a company’s outstanding shares to filter noise, and how AI-driven systems like RAG for financial knowledge bases, systems that ground AI answers in real financial documents help cut through misleading headlines. There’s no magic formula. But there is a way to think smarter when the market feels like it’s sending you conflicting texts. Let’s get you ready to answer back.