MACD Signals: How to Use Moving Averages for Better Trading Decisions

When you see a MACD signal, a technical indicator that tracks the relationship between two moving averages to spot changes in momentum. Also known as moving average convergence divergence, it helps traders decide when to buy or sell based on shifts in price direction, not just price levels. Unlike simple trend lines, MACD doesn’t just tell you if a stock is going up or down—it shows you how fast it’s accelerating or slowing down.

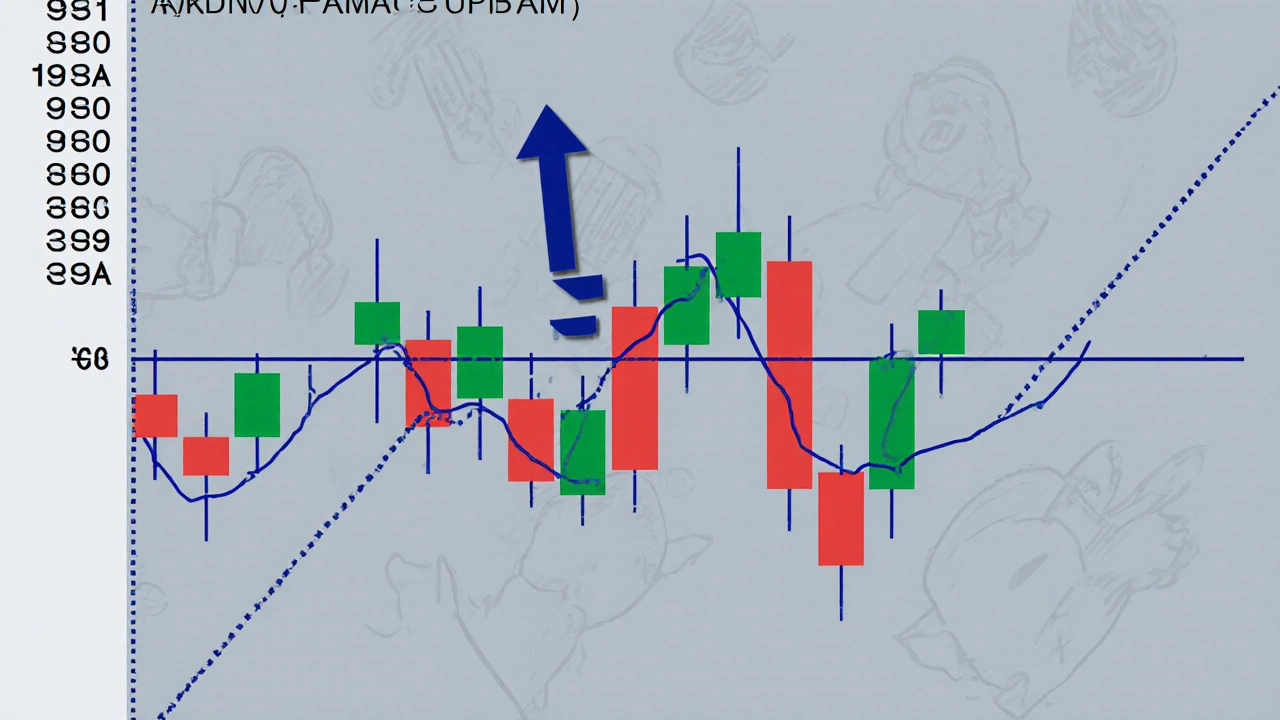

This tool combines two exponential moving averages: the 12-day and the 26-day. The difference between them forms the MACD line. Then there’s the signal line—a 9-day average of that MACD line. When the MACD line crosses above the signal line, it’s a classic buy signal. When it drops below, that’s a sell signal. Traders also watch for divergences, where price moves one way but the MACD moves the opposite direction. That often means the current trend is losing steam. These aren’t magic bullets, but they’re widely used because they turn raw price data into clear, actionable triggers.

MACD signals work best when paired with other context. For example, if you see a bullish MACD crossover during a pullback in a stock with strong volume and rising earnings, that’s more meaningful than the same signal in a choppy, low-volume market. Many of the posts below show how investors combine MACD with other tools like volume trends, support levels, or even dividend safety scores to filter out false signals. You won’t find anyone using MACD alone to make life-changing trades—but you’ll find plenty using it as a reliable filter in a larger strategy.

You’ll also see how MACD behaves differently across asset types. It’s more reliable with stocks that have steady trading volume, like large-cap dividend payers, than with highly volatile crypto or penny stocks. The same crossover that works on Apple might give you a false alarm on a small-cap biotech. That’s why understanding the context matters as much as the indicator itself.

What’s clear from the posts below is that MACD signals aren’t about predicting the future. They’re about reading the current energy in the market. They help you spot when momentum is shifting—and that’s often the difference between holding too long or getting out before a drop. Whether you’re tracking dividend stocks, growth ETFs, or even small business financing trends through market movements, understanding how momentum changes gives you an edge.

Below, you’ll find real examples of how investors use MACD signals alongside other tools—from options trading to dividend safety checks—to build smarter, more responsive strategies. No theory. No fluff. Just what works when the market moves.