Interest Rates: How They Shape Your Investments and Savings

When you hear interest rates, the cost of borrowing money or the return you earn on savings, set by central banks and influenced by inflation and economic growth. Also known as benchmark rates, they’re the invisible force behind every loan, mortgage, and bond you own. If they rise, your savings account might finally pay more—but so will your credit card. If they fall, your mortgage gets cheaper, but your bond investments could lose value. It’s not just numbers on a screen; it’s your money working—or not working—for you.

Inflation, the rate at which prices rise over time, directly impacts how real interest rates behave. If inflation is 3% and your savings account pays 2%, you’re actually losing buying power. That’s why smart investors watch both together. Bond yields, the return you get from government or corporate debt, move in sync with interest rates. When the Fed hikes rates, new bonds pay more, so older ones with lower yields drop in price. That’s why bond funds can swing wildly during rate changes. And then there’s central banks, like the U.S. Federal Reserve, that control short-term rates to manage the economy. They raise rates to cool down spending and lower them to spark growth. You don’t control them—but you can plan around them.

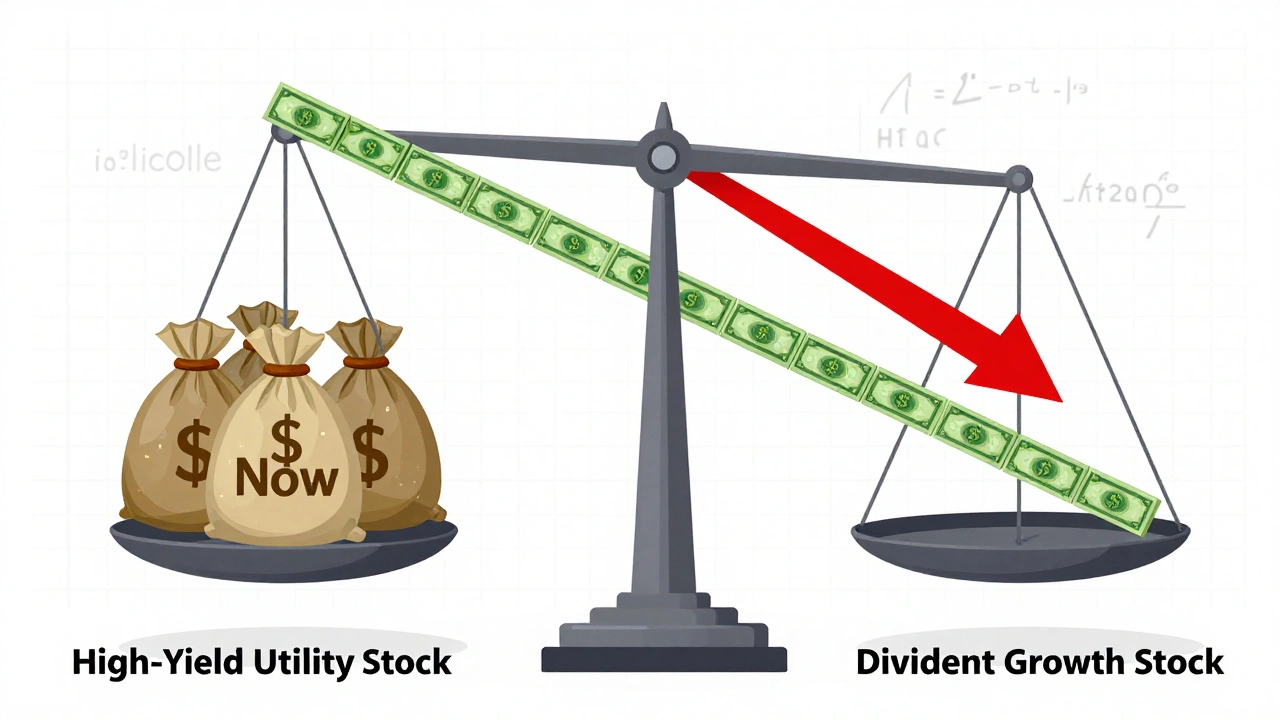

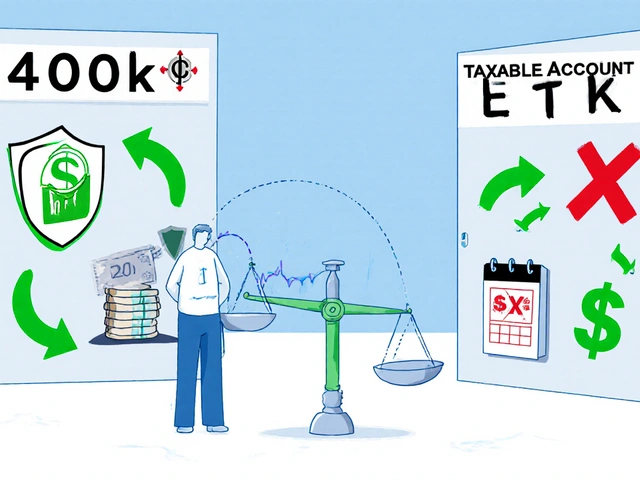

Look at the posts below. You’ll find guides on how to protect your retirement income when rates climb, how to choose between taxable and tax-deferred accounts based on current yields, and why dividend stocks sometimes outperform when borrowing costs are high. There’s advice on using Treasury bills for emergency funds when rates are above 5%, and how to spot when a company’s debt burden becomes dangerous as interest payments rise. You’ll see how asset location and tax efficiency change when the cost of money shifts. This isn’t theory—it’s what’s happening right now in portfolios, bank accounts, and retirement plans.

Whether you’re saving for a house, building passive income, or just trying not to lose money to inflation, understanding interest rates isn’t optional. It’s the foundation. The posts ahead give you the tools to read the signals, adjust your strategy, and keep your money working—even when the rates go up and down.