Hard Data in Investing: What Really Moves Markets and Why It Matters

When you hear hard data, objective, measurable financial facts that aren't based on opinions or guesses. Also known as quantitative data, it's the backbone of every smart investment decision. It’s not about what someone thinks will happen—it’s about what actually happened. Think of it like checking your car’s oil level instead of just hoping it won’t break down. In investing, hard data tells you if a company can pay its dividends, if a stock is overvalued, or if a trading signal is reliable. This isn’t fluff. It’s numbers you can count: payout ratios, market cap, T-bill yields, and MACD crossovers.

Hard data includes things like the dividend safety score, a metric that measures how likely a company is to cut its dividend based on cash flow and earnings, or market cap, the total value of a company’s outstanding shares, used to classify stocks as large-cap, mid-cap, or small-cap. These aren’t guesses. They’re facts pulled from financial statements, SEC filings, or real-time trading feeds. The MACD indicator? That’s hard data too—it’s a mathematical formula tracking momentum shifts using price history. Even UCC filings, legal documents that secure lenders’ claims on business assets, are hard data. They don’t lie. A company can’t fake its cash flow for long, and a UCC filing can’t be deleted after the fact.

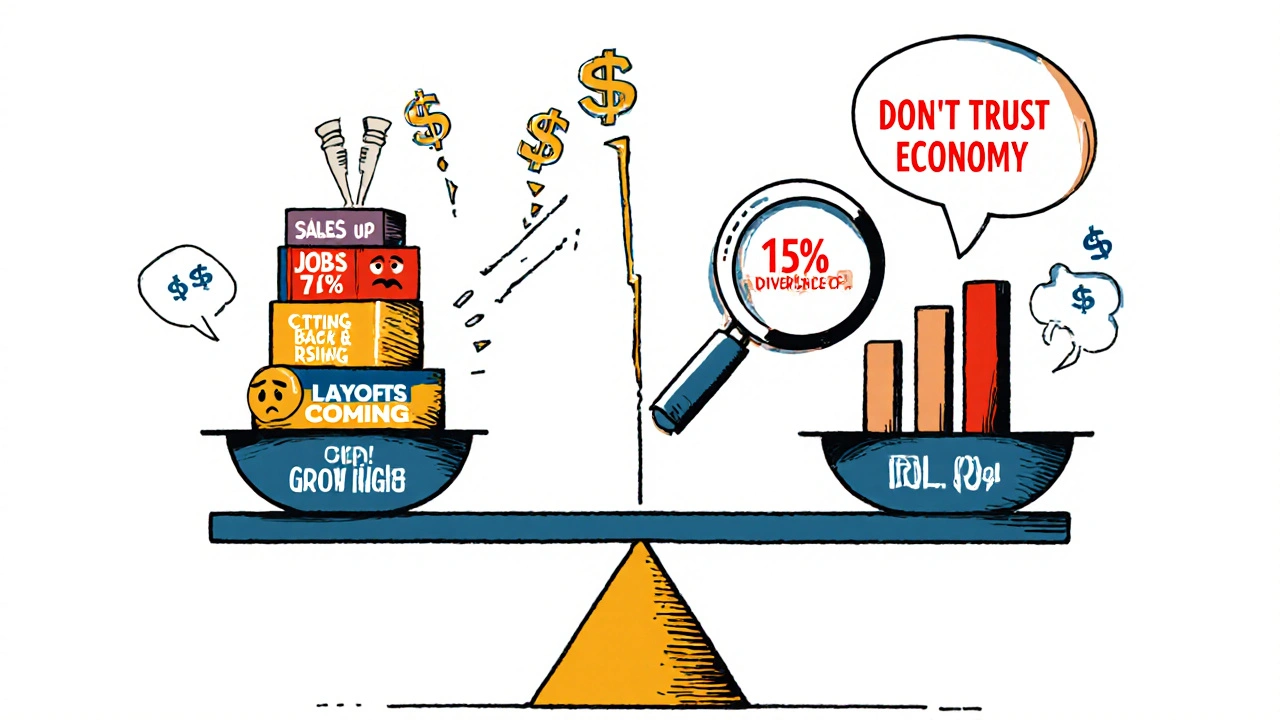

What’s missing from the noise? Emotions. Hype. Predictions. Hard data cuts through all that. If a stock looks cheap but its payout ratio is over 120%, the dividend is at risk. If a company’s market cap is rising but its revenue is flat, something’s off. If your broker’s 1099 form shows the wrong cost basis, you’re setting yourself up for an IRS audit. These aren’t theoretical risks—they’re real consequences backed by numbers. You don’t need to be a math wizard. You just need to know where to look and what to trust.

Below, you’ll find clear, no-fluff guides that show you exactly how to find, read, and act on hard data. Whether it’s spotting a dividend trap before it happens, understanding how APIs power your budgeting app, or decoding what a callable bond really means for your returns—every post here is built on numbers that matter. No opinions. No guesses. Just what’s real.