Dividend Growth: How to Build Reliable Income and Long-Term Wealth

When you invest in dividend growth, the strategy of buying stocks that consistently raise their payouts over time. It’s not about the biggest check you get today—it’s about the bigger one next year, and the one after that. Unlike stocks that pay a flat dividend and call it a day, dividend growth companies are the ones that actually grow their businesses, earn more profit, and share that success with shareholders. This isn’t magic—it’s math. Companies like Coca-Cola, Johnson & Johnson, and Microsoft have raised dividends for 50+ years because they make money, manage costs, and keep reinvesting wisely.

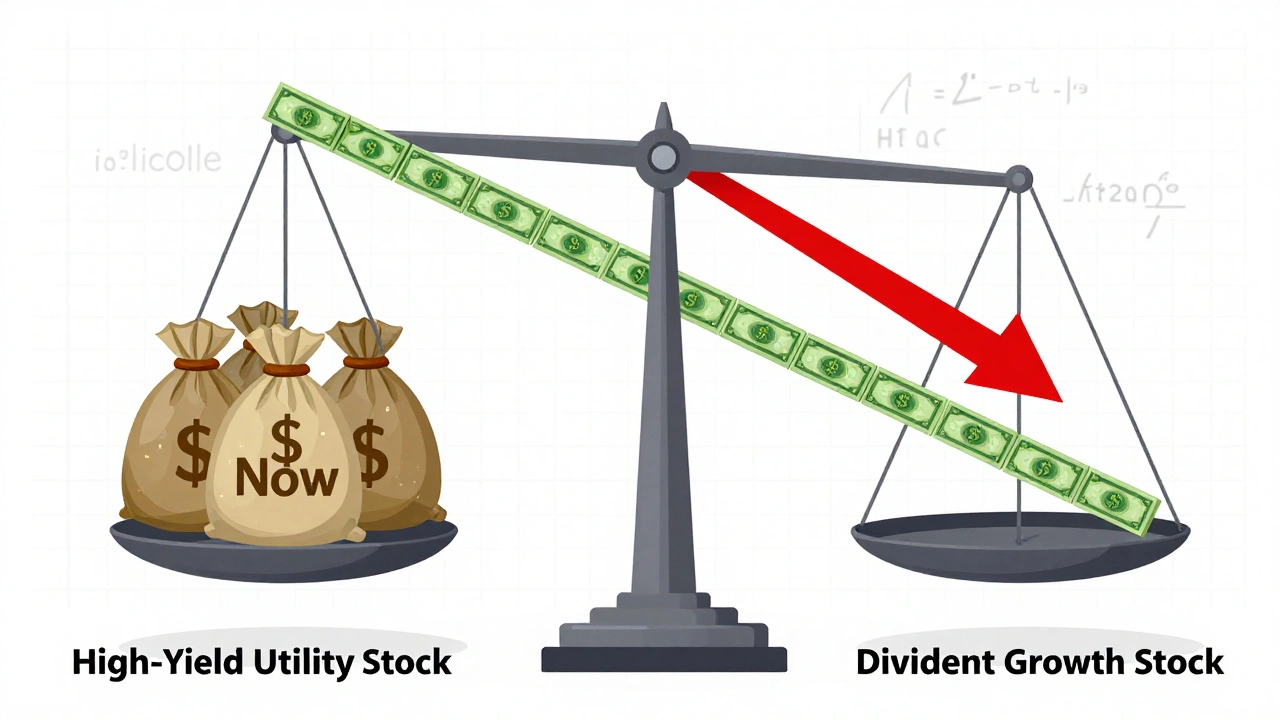

What makes dividend growth work is the compounding effect. Reinvest those rising payouts, and over time, your income doesn’t just grow—it accelerates. A $1,000 investment in a stock paying 3% today might pay you $50 a year. But if that dividend grows 7% annually, in 15 years, you’re pulling in over $130 a year—just from the same shares. And you didn’t have to sell anything. That’s the power of dividend-paying stocks, companies that regularly distribute profits to shareholders. income stocks are the engine behind this, but only the ones with real earnings growth matter. You can’t fake it. A company that pays a high dividend but has a payout ratio, the percentage of earnings paid out as dividends over 80% is one bad quarter away from cutting its dividend. That’s why smart investors look at cash flow, debt levels, and history—not just the yield.

Dividend growth isn’t for traders. It’s for people who want to build a reliable stream of income that keeps up with inflation, reduces portfolio stress, and works while you sleep. It’s the quiet side of investing that most people ignore until they need it. The posts below cover exactly how to spot these companies, avoid traps, track your income over time, and place them in the right accounts to keep more of what you earn. You’ll find real tools, real metrics, and real examples—not theory. Whether you’re just starting out or already holding a few dividend stocks, there’s something here that’ll help you make better decisions and sleep better at night.