Capital Gains Tax: What It Is, How It Works, and How to Keep More of Your Profits

When you sell an investment for more than you paid, the profit is called a capital gain, the profit from selling an asset like stocks, real estate, or mutual funds. Also known as realized gain, it’s what triggers capital gains tax, a tax on investment profits that varies by how long you held the asset and your income level. This isn’t just a number on a tax form—it directly cuts into your returns, and smart investors plan for it before they even buy.

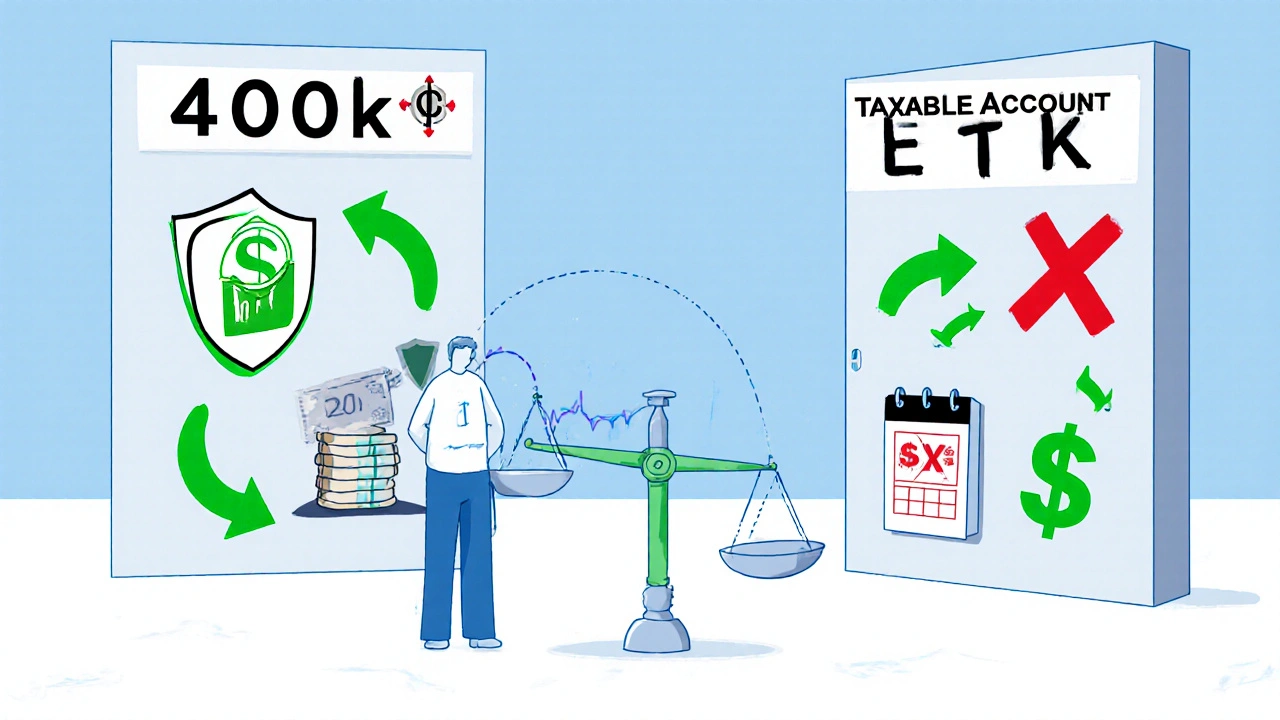

How much you pay depends on two things: how long you held the asset and your income. If you held it less than a year, it’s taxed as ordinary income—sometimes as high as 37%. If you held it longer, you get the lower long-term rate, which can be as low as 0% if you’re in a lower tax bracket. But here’s the twist: taxable brokerage, a regular investment account where you pay taxes on gains and dividends each year is where most of this hits you. That’s why placing the right assets in the right accounts matters. For example, putting high-growth stocks in a Roth IRA, a tax-free retirement account where qualified withdrawals aren’t taxed lets you avoid capital gains tax entirely. This strategy is called tax coordination, the practice of placing assets in accounts to minimize overall tax burden. It’s not magic—it’s math. And it can add up to nearly 1% extra in annual returns, just by moving where your money sits.

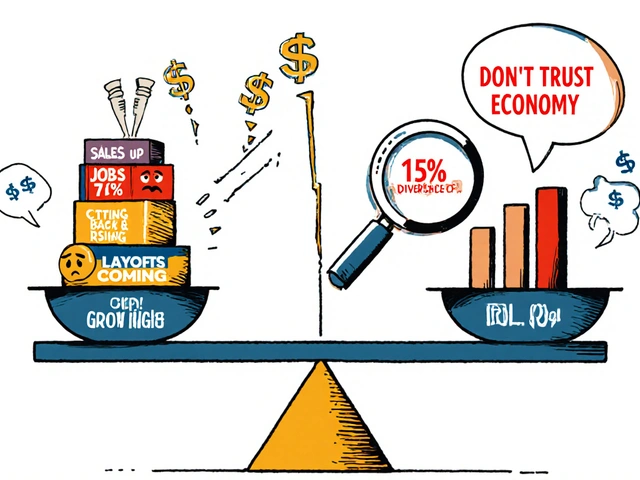

Many people think capital gains tax only matters if they’re rich. But even small investors feel it. Selling a stock that went up $500? That’s a $75 tax bill if you’re in the 15% long-term bracket. That’s $75 you didn’t earn—you just got taxed on paper gains. The good news? You have control. You can delay selling to qualify for long-term rates. You can offset gains with losses (that’s tax-loss harvesting). You can shift assets to accounts that shield you from the tax altogether. The posts below show you exactly how other investors are doing this—whether they’re using multiple account types, tracking performance across platforms, or choosing brokers that make tax reporting easier. You’ll see real examples, not theory. No fluff. Just what works.