API Integration: Connect Financial Tools and Automate Your Investing Workflow

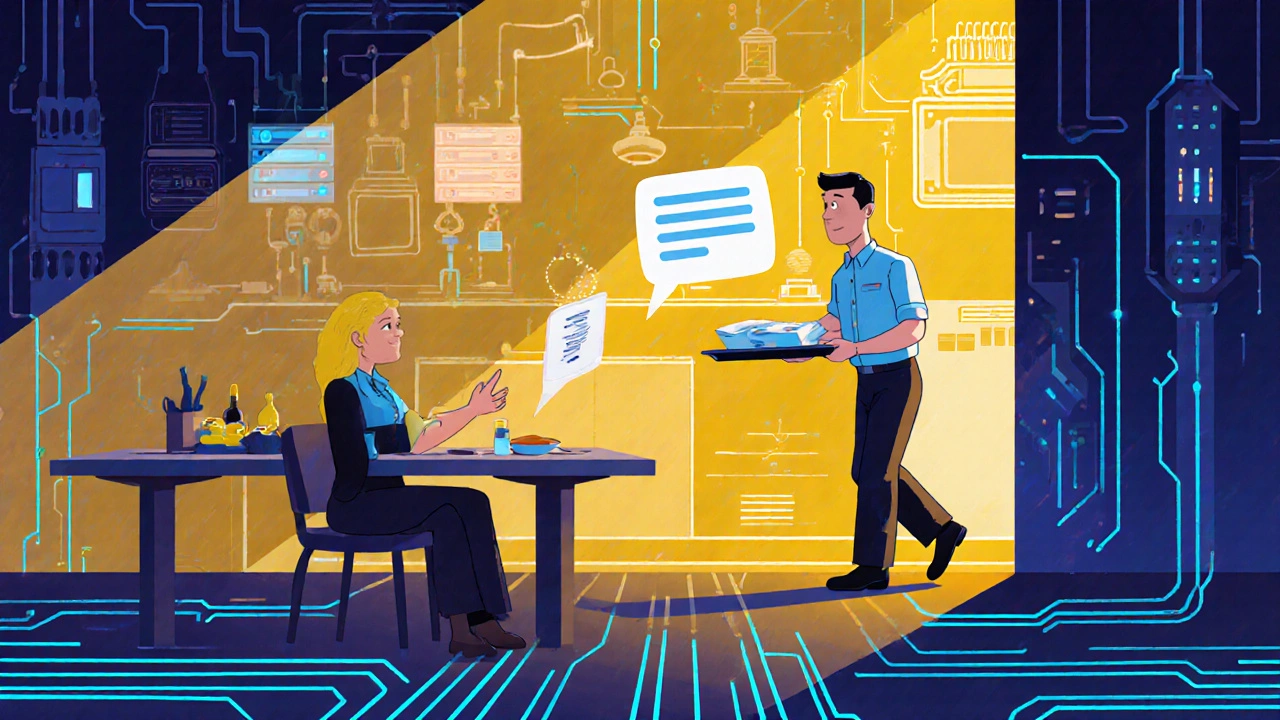

When you use API integration, a system that lets different software applications exchange data automatically. Also known as application programming interface connection, it’s what makes your budgeting app pull transactions from your bank, or lets a trading tool pull real-time market data without you copying and pasting a thing. This isn’t sci-fi—it’s the quiet engine behind every modern finance tool you use.

Think about embedded lending, a system where small businesses get instant cash by connecting their accounting software directly to lenders. It only works because the lender’s system talks to QuickBooks or Xero through an API integration. Without it, you’d be emailing invoices, waiting days for approval, and filling out paper forms. Same goes for open banking, the legal framework that lets apps access your financial data with your permission. It relies on standardized APIs to categorize spending, track balances, and give you real insights—no manual entry needed. Even loan underwriting automation, where AI approves small business loans in minutes, uses API integration to pull bank statements, tax filings, and sales data in seconds instead of weeks. These aren’t separate trends—they’re all built on the same foundation: systems talking to each other cleanly and securely.

What you’ll find in this collection are real examples of how API integration changes how people invest, manage cash, and run businesses. You’ll see how it powers automated trading signals, connects dividend trackers to brokerage accounts, and helps fintechs avoid human error in compliance. Some posts show you how it cuts costs for small businesses. Others reveal how it makes financial AI more accurate by pulling from live data instead of stale reports. There’s no theory here—just what works, what fails, and why it matters when your money’s on the line.