Tax-Deferred Accounts: How to Grow Wealth Without Paying Taxes Now

When you invest in a tax-deferred account, a retirement or investment vehicle where you don’t pay taxes on earnings until you withdraw the money. Also known as pre-tax accounts, it lets your money compound faster because you’re not losing a chunk to taxes every year. That’s the big advantage: more growth, more time, more money in your pocket later.

Most people use 401(k), an employer-sponsored retirement plan where contributions come out of your paycheck before taxes or IRA, an individual retirement account you open on your own, with options like Traditional or SEP. These aren’t just for retirement—they’re tools to delay taxes, not avoid them. The IRS lets you skip taxes now, but you’ll pay when you take money out, usually in retirement when your income—and tax rate—might be lower. That’s the trade-off: pay later, not now.

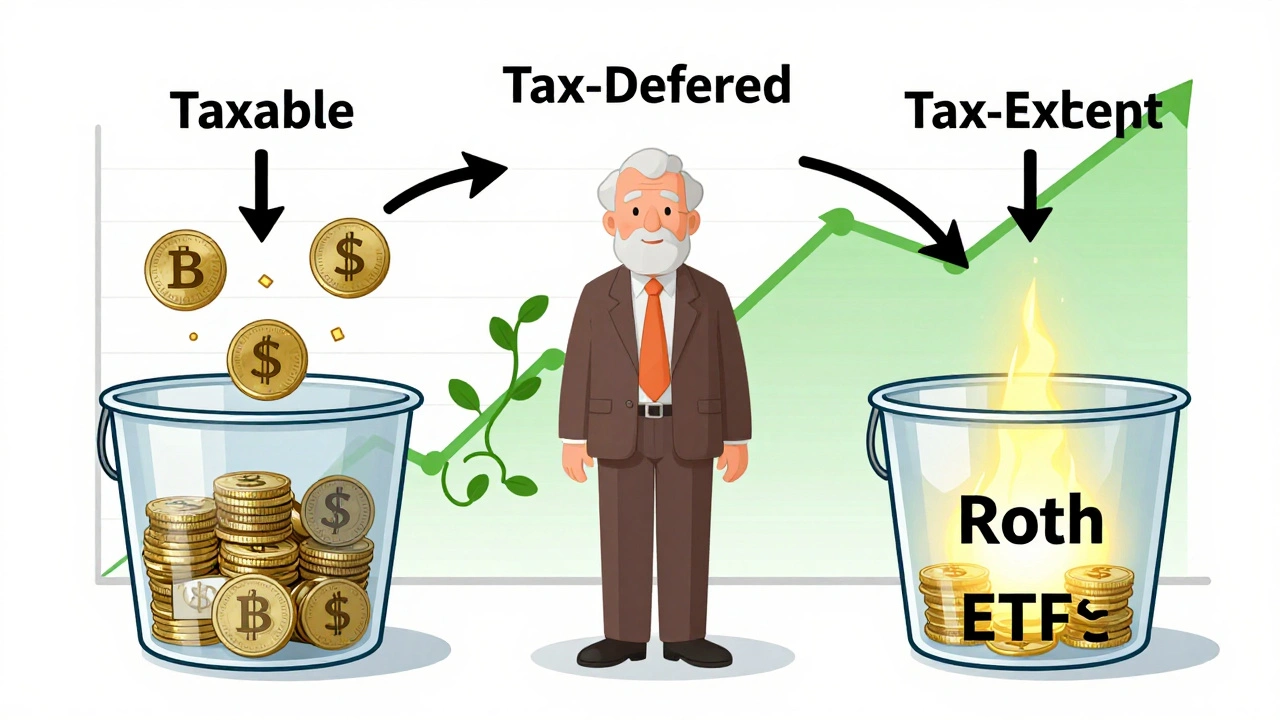

But here’s the thing: tax-deferred accounts work best when you pair them with taxable brokerage accounts, standard investment accounts where you pay taxes on dividends and capital gains each year. Why? Because you can rebalance smarter. If you sell stocks in your 401(k), no capital gains tax. But if you sell in a taxable account, you owe taxes. That’s why smart investors hold high-growth assets in tax-deferred accounts and slower, dividend-paying ones in taxable accounts. It’s not magic—it’s just tax-aware asset location, something you’ll see covered in several posts below.

These accounts aren’t free money. They come with rules: withdrawal limits, required minimum distributions after age 73, and penalties if you pull money out too early. But if you play by the rules, they’re one of the most powerful ways to build wealth. You’re not just saving—you’re letting the government give you a low-interest loan on your own money, interest-free, for decades.

What you’ll find in these posts isn’t theory. It’s real strategies from people who’ve used tax-deferred accounts to cut their tax bills, boost returns, and avoid costly mistakes. You’ll see how to use them alongside taxable accounts, how to rebalance without triggering taxes, and why some people skip Roth IRAs entirely in favor of traditional ones. No fluff. No jargon. Just what works.