Plantation Resort Capital: Smart Investing Strategies for Real Results

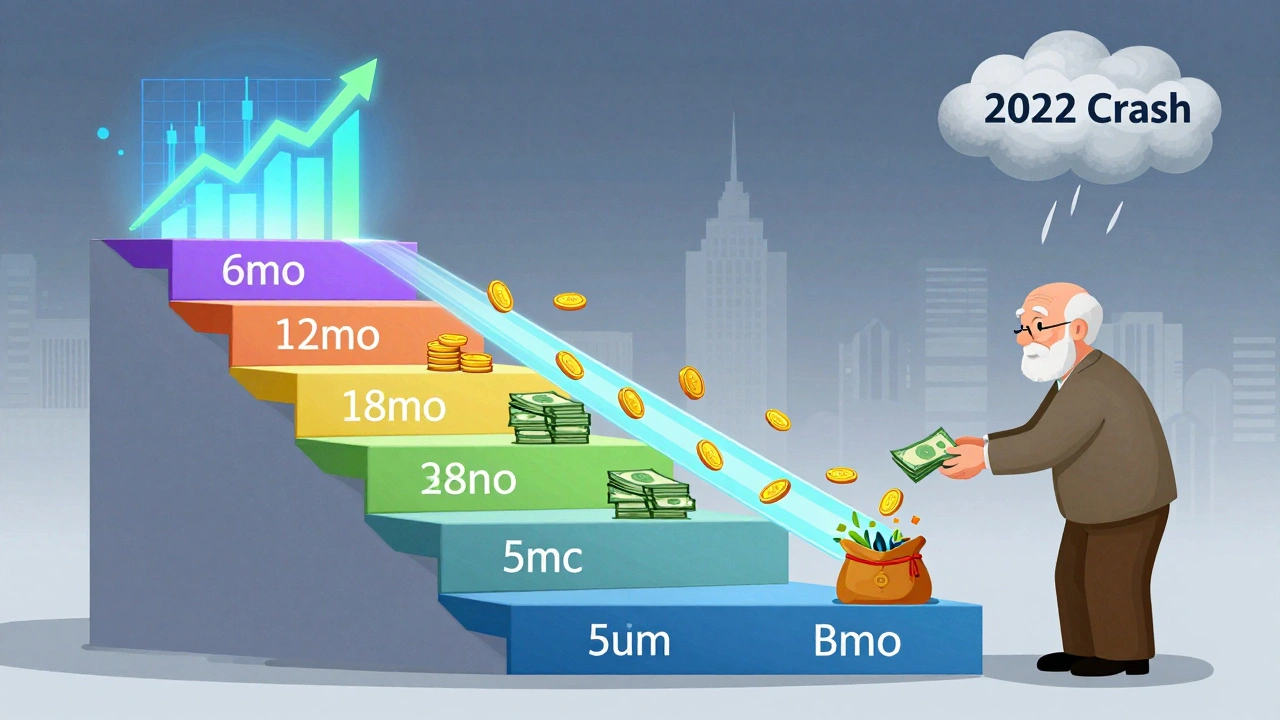

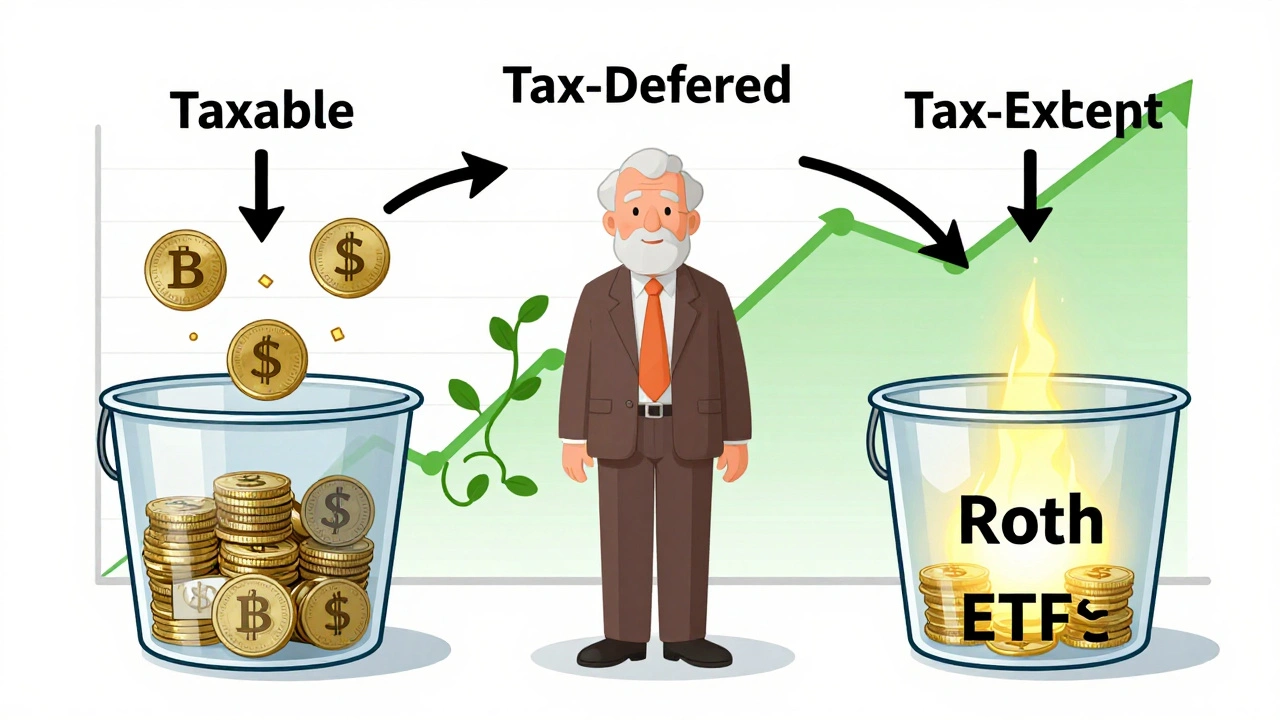

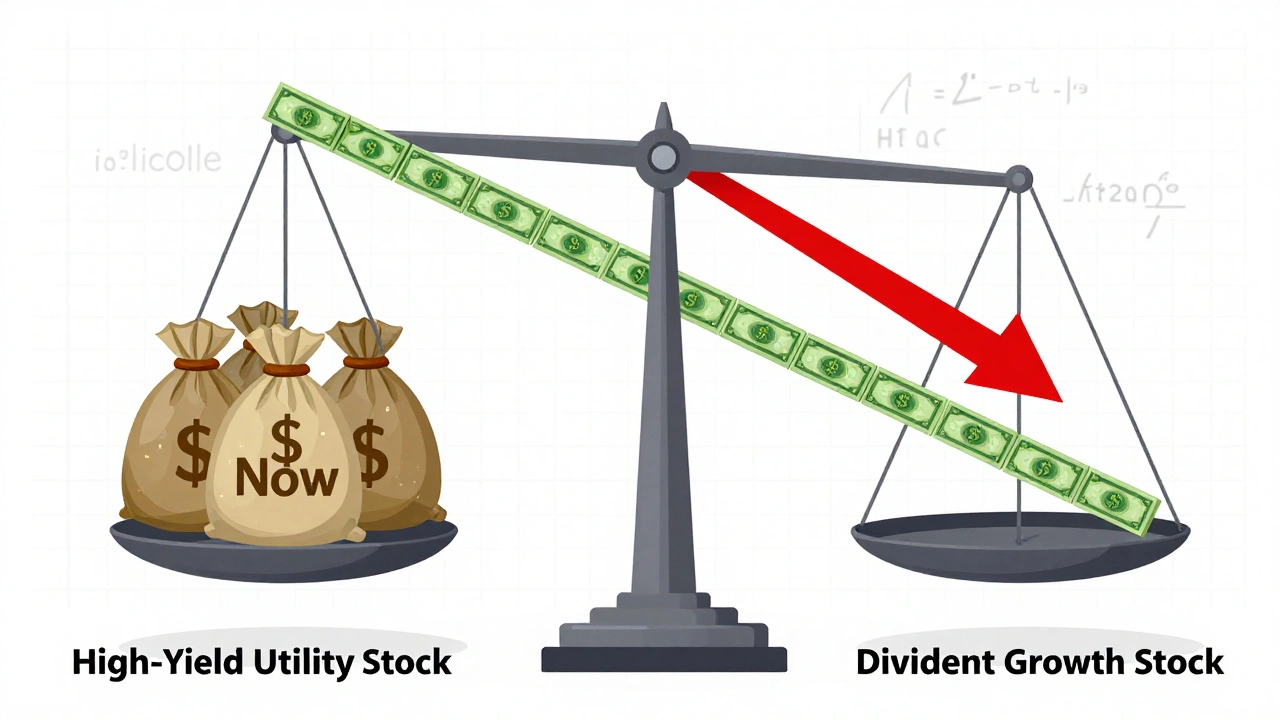

When you're building wealth, Plantation Resort Capital, a practical guide to investing that cuts through the noise and focuses on real outcomes. It's not about chasing trends—it's about making smart, repeatable choices that work whether you're just starting out or already managing a portfolio. You'll find real advice on how to use taxable brokerage accounts, investment accounts where you control when to pay taxes and how to use gains alongside retirement accounts to boost your after-tax returns. Many people miss how tax coordination, the smart placement of assets across different account types to minimize taxes can add nearly 1% to your yearly growth. And if you're wondering where to keep your safety net, we break down what actually works for emergency funds, cash set aside for unexpected expenses, organized in ways that balance access and growth—separate or combined, with data to back it up.

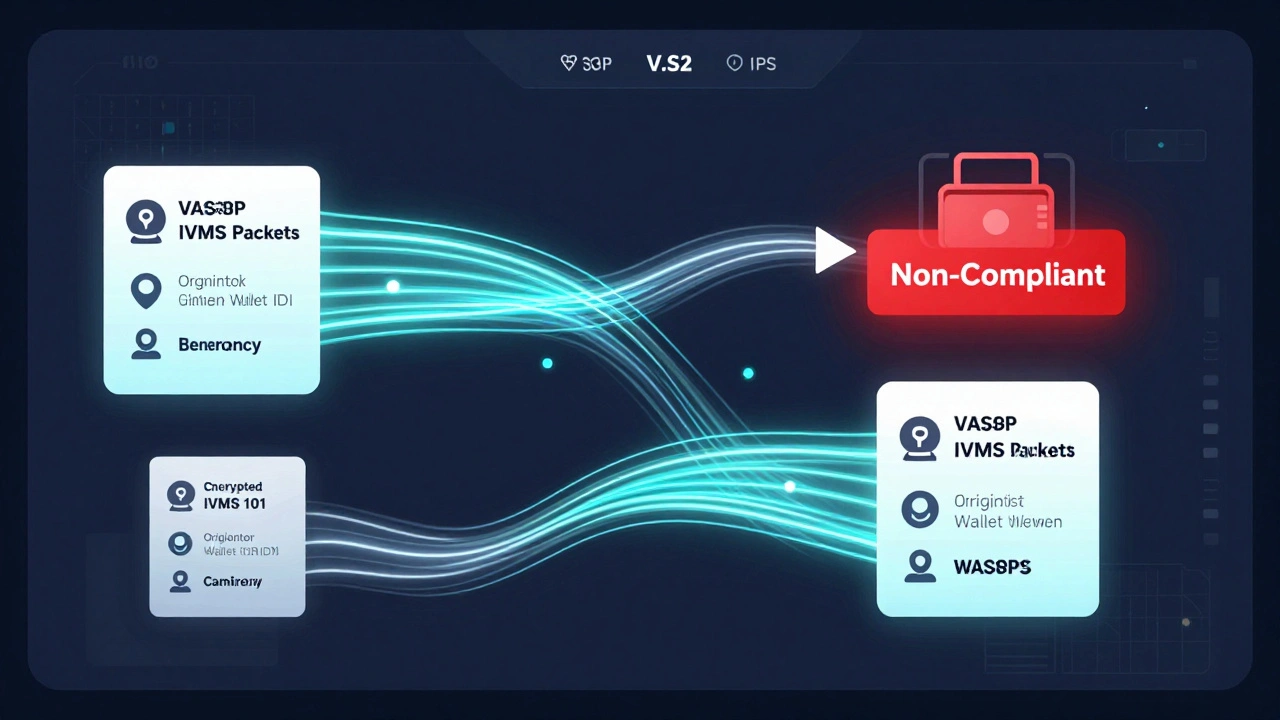

Behind the scenes, modern tools like fintech lending, automated loan systems that use AI to approve small business loans in minutes are changing how money moves. We don’t just explain these tools—we show you how they connect to your own goals, whether you’re saving for a house, managing risk, or trying to generate passive income without guesswork.

Below, you’ll find no fluff, no theory without proof—just clear, tested strategies that real people use to build wealth without stress.